Invoice # Must Be Unique

This error means that there is already an existing invoice in Xero with the invoice number that is being sent across, note that Xero requires invoice numbers to be unique, else there will be problems with syncing across from Procore > Xero.

Cost Code is Not Chargeable

This error occurs when sending across an invoice/bill to Procore when the mapping will cause the invoice/bill to end up on a header level cost code.

Note that a header level cost code will be displayed with a ‘folder’ icon inside your company’s work breakdown structure:

So, for example, cost code “1 – General Requirements” in this case is a header level cost code. This means that it cannot be charged (have a cost associated with it directly) inside of Procore. Thus, your cost code and account code mapping should be amended to make sure that invoices/bills pushing across from Xero do not push to this cost code. An example of a chargeable cost code in this case would be “1 – 0 Purpose”.

The Mapping for the Following Xero Account Code is Missing

This error will appear if the account code has not been mapped to a Procore cost code. Note that this is only an issue if you wanted this invoice/bill to end up in Xero, as in many cases not everything that is entered in Xero is desired to be in Procore. If you wish to amend this, update your mapping in the integration.

Could Not Initiate The Following Invoice

This means that the Xero invoice will not go across to Procore for a variety of reasons, for example it may not be under one of the mapped account codes if there is no default set. This error is not necessarily of concern unless you check and see the invoice in Xero and make sure that you wished for it to sync to Procore. This can be done by clicking the button on the right of the sync log:

The TaxType Code ” ” cannot be used with account code ” “

This error usually refers to an issue in Xero with account code types, for example pushing revenue to an expense code, Xero has limitations around which account types can be used for certain kinds of transactions. A typical example of this is using expense account codes for your head contract progress claim, which can be solved by making the head contract progress claim use the default xero invoice code in the head contract settings.

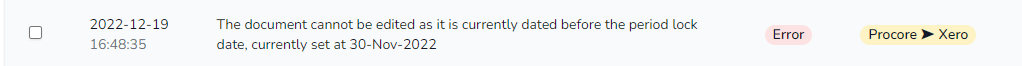

The document cannot be edited as it is currently dated before the period lock date

This means that there has been a lock date set in Xero which means that the invoice or bill is no longer editable. The integration will not be able to sync changes to the invoice in Xero from Procore while there is a lock date set for it. For information from Xero about period lock dates, see this article from Xero.